capital gains tax canada changes

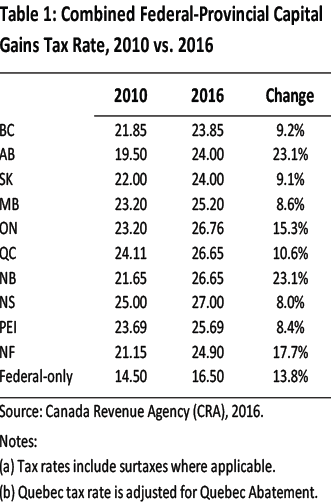

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

Planning Around The 2017 Federal Budget Possible Changes To The Capital Gains Inclusion Rate Tax Authorities Canada

Principal residence and other real estate.

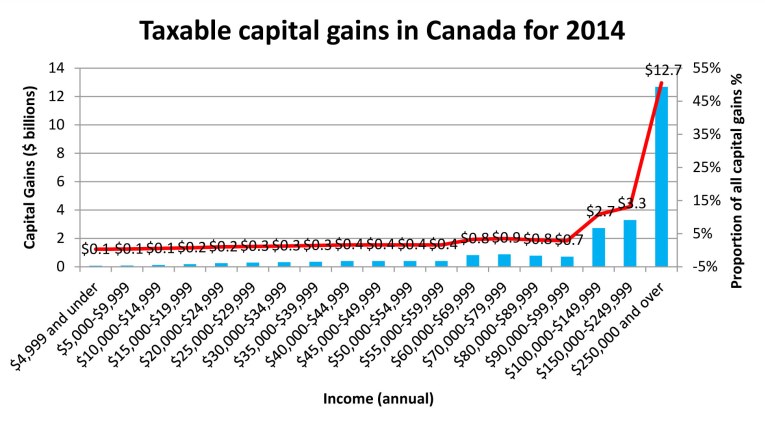

. The current tax preference for capital gains costs 35 billion annually with high-income families accruing most of the benefit. Today announced the estimated annual capital gains distributions for the Vanguard ETFs listed. Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Under the rules currently in force only until the end of. Australia introduced a similar tax later in 1985.

NDPs proto-platform calls for levying higher taxes on the ultra-rich and. In other words for every 100 of. The sale price minus your ACB is the capital gain that youll need to pay tax on.

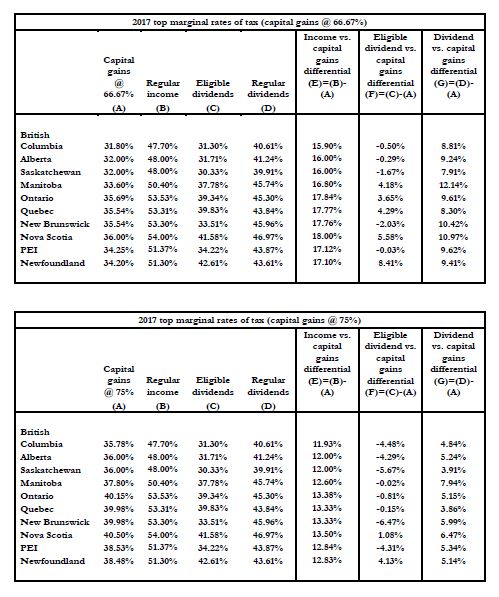

So if you make 1000 in capital gains on an investment you will pay capital gains tax. Historically Canadian income tax law has by design allowed for preferential tax treatment of Eligible Capital Property. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338.

A cut in the Capital Gains Tax threshold from 12000 to 6000 meanwhile is set to hit those with their cash outside ISAs and pensions tax wrappers who will now pay a higher. Was introduced in 1965. For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022.

For more information see What is the capital gains deduction limit. A comprehensive capital gains tax in the UK. 17 2022 CNW - Vanguard Investments Canada Inc.

Line 12700 - Taxable capital gains. Federal Tax Rate Brackets in 2022. The recent passage of Bill C-208 exacerbates.

The government would like to see the tax rate on both capital gains and dividend income be the same. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. In this article we outline the history of capital gains taxation in Canada describe some of the.

Currently long-term capital gains are in general taxed at 20. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously. Since its more than your ACB you have a capital gain.

A hike in capital gains tax rates to equalise them with income taxes had been mooted but Hunt has instead opted to hack back the tax-free allowance and halved it from. Currently depending on your tax bracket a capital gain is taxed at a. The experience in the US.

Is more mixed where capital. The below outlines the current tax treatment of capital gains in Canada and the US the appetite for change in each country and a few questions to ask your financial. Your sale price 3950- your ACB 13002650.

January 1 2022 marks the 50th anniversary of the capital gains tax in Canada. The inclusion rate has varied over time see graph below. As of 2022 it stands at 50.

The taxes in Canada are calculated based on two critical variables. Long-term capital gains tax in the case of equities is 10 if the total gain in a financial year exceeds Rs 1 lakh. The inclusion rate refers to how much of your capital gains will be taxed by the CRA.

Tax Changes in 2022. When there is a change in use of a property you have you may be.

Too Many Analyses Misrepresent Capital Gains Income And Taxes Fraser Institute

Personal Income Taxes And The Capital Gains Tax Fraser Institute

Misunderstandings About Capital Gains Taxes Fraser Institute

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

Historical Capital Gains Rates Wolters Kluwer

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

How Do Taxes Affect Income Inequality Tax Policy Center

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Complete Guide To Canada S Capital Gains Tax Zolo

The States With The Highest Capital Gains Tax Rates The Motley Fool

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Mechanics Of The 0 Long Term Capital Gains Rate

Capital Gains Tax Break Becomes Part Of A Double Whammy When Home Prices Fall Don Pittis Cbc News

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool